As Pakistan’s largest bank, Habib Bank Limited offers a wide range of credit card installment plans to their clients. That is to break the cost of the goods into small but manageable amounts. Products such as electronics, furniture, tours, and tickets, among others, are available in HBL Installment Payment. Find out more about Habib Bank Limited HBL Credit Card Installment Plan 2025.

Habib Bank Limited (HBL) offers an installment plan that allows customers to pay for products in monthly installments of up to 36 months. The installment plans have a 0% markup for a period that varies by product.

The billing date for HBL credit cards is the 5th of every month, and the payment due date is the 26th of every month.

Benefits of HBL Credit Card Installment Plans

There are many benefits to using HBL credit card installment plans. Some of the most notable benefits include:

- Affordability: Installment plans can make it easier to afford large purchases by breaking them down into smaller, more manageable payments.

- Flexibility: HBL offers a variety of installment plans with different durations and interest rates, so you can choose the plan that best suits your needs.

- Convenience: You can apply for an installment plan online or at any HBL branch.

- No hidden fees: There are no hidden fees associated with HBL’s installment plans.

Eligibility for HBL Credit Card Installment Plans

To be eligible for an HBL credit card installment plan, you must:

- Be an HBL credit cardholder.

- Have a good credit history.

- Have a minimum purchase amount of Rs. 10,000.

Habib Bank Limited HBL Credit Card Installment Plan 2025

How to Apply for an HBL Credit Card Installment Plan

You can apply for an HBL credit card installment plan in two ways:

- Online: You can apply online through HBL’s internet banking portal. Click Here

- At an HBL branch: You can visit any HBL branch and apply for an installment plan in person.

Documents Required for Applying for an HBL Credit Card Installment Plan

When applying for an HBL credit card installment plan, you will need to provide the following documents:

- A copy of your CNIC.

- A copy of your latest utility bill.

- A copy of your recent salary slip.

Interest Rates for HBL Credit Card Installment Plans

HBL offers a variety of installment plans with different interest rates. The interest rate you will be charged will depend on the duration of your plan and the type of purchase you are making.

Processing Time for HBL Credit Card Installment Plans

The processing time for HBL credit card installment plans typically takes 2-3 working days.

To pay an HBL credit card bill, customers can:

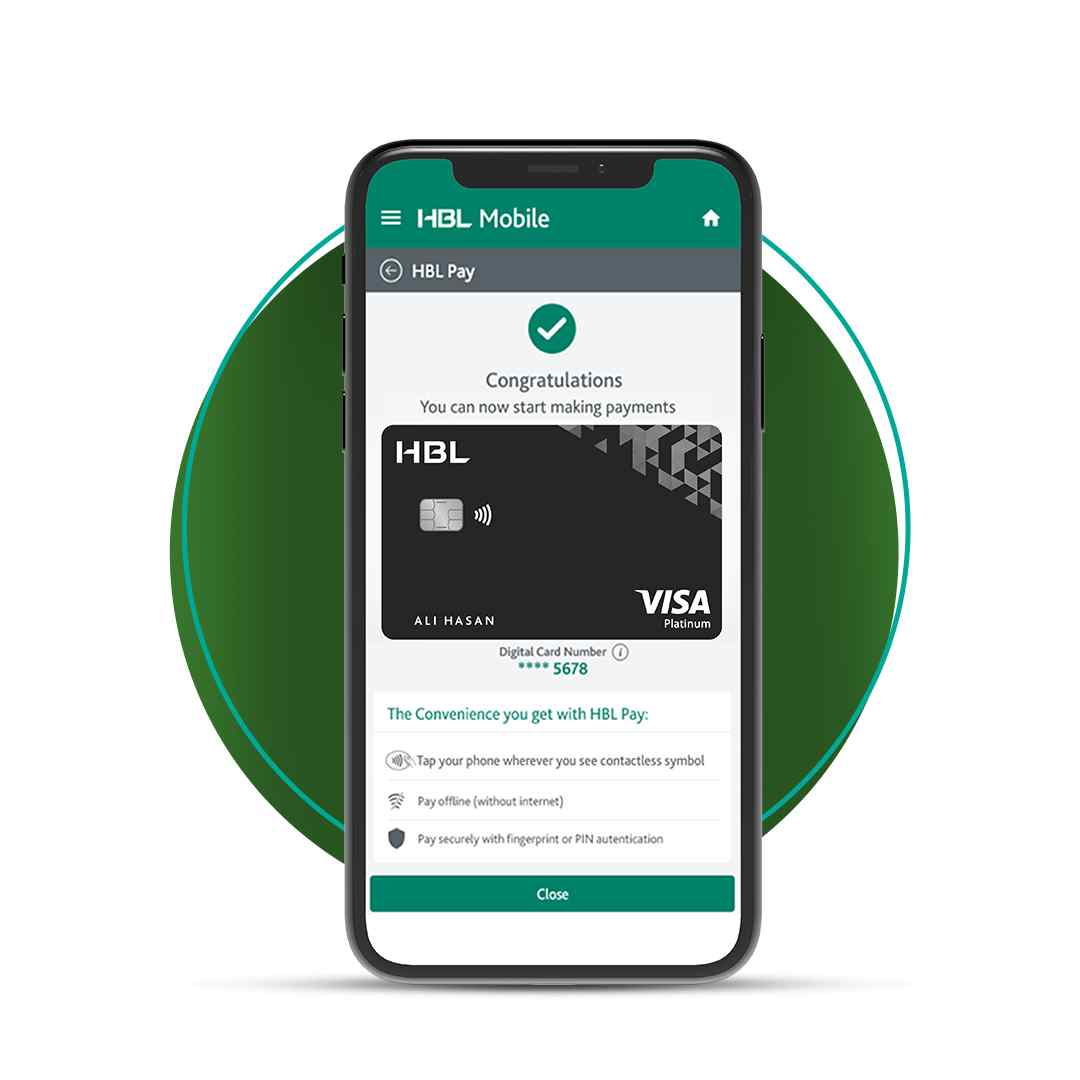

- Log in to HBL Mobile

- Select HBL Pay under the credit card section on the home page

- Select the card to add to HBL Pay

HBL Credit Card Installment Plan FAQs

A: The penalties for late payment of an HBL credit card installment plan are as follows:

- Late payment fee: Rs. 500

- Finance charges: 3% per month

Final Words

HBL credit card installment plans are a great way to make large purchases more affordable. With a variety of plans to choose from, you can find one that fits your budget and needs. If you are considering using an installment plan, read the terms and conditions carefully and understand the interest rates and fees involved. Check it: How to Check Vote Registration.